| |

|

| |

| |

| |

|

A daily bite-size selection of top business content. |

| |

| |

| |

Quote: Merton Miller - Nobel Laureate in Economics“I favour passive investing for most investors, because markets are amazingly successful devices for incorporating information into stock prices.” - Merton Miller - Nobel Laureate in EconomicsMerton Miller, Nobel Laureate in Economics, was a pivotal figure in the development of modern financial theory and a leading advocate for passive investing. The quote, “I favour passive investing for most investors, because markets are amazingly successful devices for incorporating information into stock prices,” encapsulates Miller’s lifelong commitment to highlighting the power and efficiency of financial markets. About Merton Miller Miller (1923–2000) was awarded the Nobel Prize in Economic Sciences in 1990, sharing the honour with Harry Markowitz and William Sharpe for ground-breaking work in the field of financial economics. His most influential contribution, alongside Franco Modigliani, was the Modigliani-Miller theorem—a foundational principle which rigorously proved that, under certain conditions, the value of a firm is unaffected by its capital structure. This theorem underpinned the belief that markets price information efficiently and forms an intellectual basis for the case for passive investing. Beyond his Nobel-winning research, Miller was renowned for his candid commentary on investing. He consistently argued that, while individual investors might believe they possess superior insights, markets—comprised of thousands of informed participants—collectively synthesise information so effectively that it becomes extremely difficult for any single investor to outperform the index after costs. As he famously quipped, “Everybody has some information. The function of the markets is to aggregate that information, evaluate it and get it incorporated into prices”. Context of the Quote The quote is a summation of decades of academic research and market observation. Miller, reflecting on the odds of outperforming the market, reasoned that for “most investors”, passive investing is the only rational route. He noted the steep costs of active management—not just fees, but the resources required to “dig up information no one else has yet”. For Miller, market prices reflected the best available information, making attempts to “pick winners” a game of chance rather than skill for the majority. This view gained substantial traction, especially as the academic tradition moved toward the concept of market efficiency. Miller warned pension fund managers that failing to allocate the majority of their portfolios to passive strategies—typically 70–80%, by his estimation—was not just suboptimal, but potentially a breach of fiduciary duty. Leading Theorists in Passive Investing and Market Efficiency The academic roots of passive investing run deep, with a lineage of Nobel Laureates and theorists who shaped the discipline:

Broader Context The shift towards passive investing is not merely theoretical but has reshaped global markets. Decades of empirical research confirm Miller’s central insight: most investors “might just as well buy a share of the whole market, which pools all the information, than delude themselves into thinking they know something the market doesn’t”. Despite periodic debate—such as whether passive investing could itself distort markets—the evidence and leading academic voices overwhelmingly endorse its primacy for the majority of investors. Key Themes

Summary Table: Leading Theorists in Passive Investing Merton Miller’s quote stands not as a passing remark, but as the distilled wisdom of a career devoted to understanding and proving the power of markets. It is a touchstone statement for a generation of investors and fiduciaries committed to evidence over speculation, and efficiency over expense.

|

| |

| |

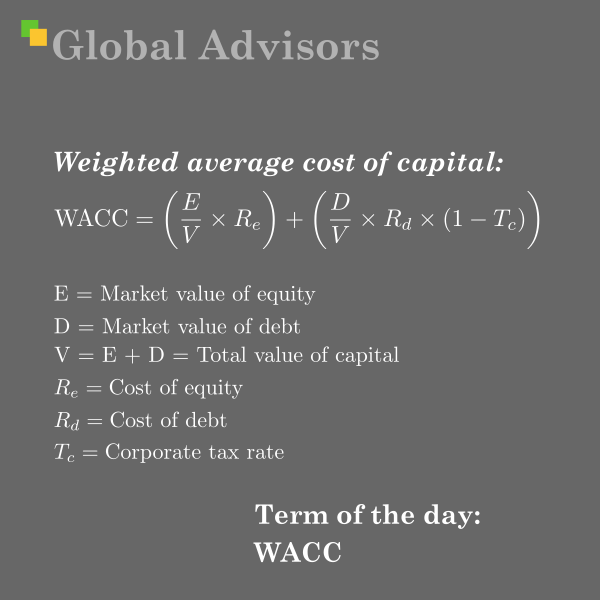

Term: Weighted Average Cost of Capital (WACC)The Weighted Average Cost of Capital (WACC) stands as one of the most fundamental and influential concepts in modern corporate finance, representing the blended cost of all capital sources a company employs to fund its operations and growth initiatives. This comprehensive metric, which integrates the costs of debt, equity, and preferred stock according to their proportional weights in a firm's capital structure, serves as a critical benchmark for investment decisions, corporate valuation, and strategic financial planning. The theoretical underpinnings of WACC trace back to the groundbreaking work of economists Franco Modigliani and Merton Miller, whose capital structure propositions in the late 1950s revolutionised corporate finance theory and established the intellectual framework upon which WACC calculations are built. Their seminal research demonstrated that under certain idealised conditions, a firm's value remains independent of its capital structure, whilst also revealing how real-world factors such as taxation, bankruptcy costs, and information asymmetries create opportunities for optimal capital structure decisions that directly impact WACC calculations. Today, WACC functions not merely as an academic construct but as a practical tool employed by corporate executives, investment analysts, and strategic advisors to evaluate project feasibility, determine appropriate discount rates for discounted cash flow analyses, and assess the relative attractiveness of different financing strategies in an increasingly complex global financial landscape. Historical Context and Theoretical FoundationsThe conceptual foundation underlying WACC calculations emerged from a revolutionary period in academic finance during the mid-20th century, when traditional approaches to corporate finance were being fundamentally challenged by rigorous economic theory. Prior to this transformation, corporate finance decisions were often guided by rules of thumb and conventional wisdom rather than systematic theoretical frameworks. The landscape began to shift dramatically with the introduction of the Modigliani-Miller theorem, which provided the first comprehensive theoretical analysis of how capital structure decisions affect firm valuation. Franco Modigliani and Merton Miller's initial proposition, published in 1958, fundamentally challenged prevailing notions about optimal capital structure by demonstrating that under perfect market conditions—characterised by the absence of taxes, bankruptcy costs, agency costs, and asymmetric information—a firm's value remains entirely independent of its financing decisions. This seemingly counterintuitive finding suggested that whether a company funded its operations through debt, equity, or any combination thereof, its overall enterprise value would remain constant. The theorem's elegant mathematical proof relied on arbitrage arguments, showing that investors could replicate any corporate financing decision in their personal portfolios, thereby eliminating any potential value creation from capital structure choices. However, the true power of the Modigliani-Miller framework emerged not from its initial proposition but from its subsequent refinements that acknowledged real-world market imperfections. The second iteration of their work, incorporating corporate taxation, revealed that debt financing could indeed create value through the tax deductibility of interest payments. This insight established the theoretical basis for what would later become the interest tax shield component of WACC calculations, demonstrating that the after-tax cost of debt should be lower than its nominal cost due to the tax benefits associated with interest payments. The implications of this refined Modigliani-Miller theorem extended far beyond academic theory, establishing the intellectual groundwork for modern approaches to capital structure optimisation. By recognising that tax considerations create a genuine preference for debt financing—at least up to a certain point—the theorem provided the theoretical justification for the weighted average approach that characterises WACC calculations. The framework demonstrated that companies could potentially reduce their overall cost of capital by strategically balancing the tax advantages of debt against the increased financial risk and potential distress costs associated with higher leverage. This theoretical evolution coincided with broader developments in financial economics, including the emergence of portfolio theory and the capital asset pricing model, which provided sophisticated methods for estimating the cost of equity capital. These complementary theoretical advances created the comprehensive framework necessary for practical WACC calculations, combining insights about optimal capital structure with quantitative methods for determining the required returns on different types of capital. The convergence of these theoretical streams established WACC as both a conceptually sound and practically implementable tool for corporate financial decision-making. Components and Mathematical Framework of WACCThe calculation of WACC requires a sophisticated understanding of its constituent components, each of which presents unique challenges in terms of measurement and estimation. The fundamental WACC formula, expressed as WACC = (E/V × Re) + (D/V × Rd × (1 - Tc)), encapsulates the weighted contribution of each capital source to the firm's overall cost of capital. This deceptively simple equation masks considerable complexity in the determination of each component, requiring careful attention to market values, risk assessments, and tax considerations.

The weighted average cost of capital (WACC) is the average rate a company must pay to all its capital providers—including both equity investors and lenders—weighted by the proportion each source represents in the firm's capital structure, and is commonly used as the discount rate in valuing investments and determining a business’s required rate of return.

The cost of equity component represents perhaps the most challenging element of WACC calculations, as equity capital lacks the explicit contractual terms that characterise debt instruments. Unlike debt, where interest rates provide a clear indication of the cost of capital, equity investors' required returns must be inferred from market data and theoretical models. The Capital Asset Pricing Model (CAPM) serves as the predominant framework for estimating the cost of equity, expressing this cost as the sum of a risk-free rate and a risk premium determined by the stock's beta coefficient and the market risk premium. The CAPM approach begins with the identification of an appropriate risk-free rate, typically derived from government securities with maturities matching the investment horizon under consideration. The selection of the risk-free rate requires careful attention to market conditions and the specific context of the analysis, as rates can vary significantly across different time periods and economic environments. The model then incorporates the stock's beta coefficient, which measures the systematic risk of the investment relative to the broader market. Beta estimation involves statistical analysis of historical stock price movements relative to a market index, though this backward-looking approach may not fully capture future risk characteristics. The equity risk premium, representing the additional return that investors demand for bearing systematic market risk, requires estimation based on historical market data or forward-looking indicators. This component of the cost of equity calculation has proven particularly contentious among practitioners, as historical risk premiums may not accurately reflect future market conditions. Some analysts prefer to use implied risk premiums derived from current market valuations, whilst others rely on long-term historical averages or survey-based estimates of investor expectations. Alternative approaches to estimating the cost of equity include the dividend capitalisation model, which derives required returns from dividend payments and expected growth rates. This method proves particularly useful for companies with established dividend policies and stable growth patterns. The dividend capitalisation model expresses the cost of equity as the sum of the dividend yield and the expected dividend growth rate, providing a more direct link between current market conditions and required returns. However, this approach becomes less reliable for companies that do not pay dividends or have highly variable dividend policies. The cost of debt component typically proves more straightforward to calculate than the cost of equity, as it reflects the explicit interest rates that companies pay on their borrowing. For companies with publicly traded debt, the cost of debt can be estimated using the yield to maturity on outstanding bonds, adjusted for any differences between the current credit rating and the rating at the time of issuance. Companies without publicly traded debt require alternative approaches, such as examining the borrowing costs of similarly rated companies or estimating credit spreads based on financial metrics and credit ratings. The tax shield benefit associated with debt financing represents a crucial component of WACC calculations, reflecting the value created by the tax deductibility of interest payments. The after-tax cost of debt, calculated as Rd × (1 - Tc), captures this benefit by reducing the effective cost of debt financing. However, the realisation of tax benefits depends on the company's ability to generate sufficient taxable income to utilise the interest deductions, a consideration that becomes particularly important for companies with volatile earnings or those operating in low-tax jurisdictions. The determination of appropriate weights for debt and equity requires market-based valuations rather than book values, as market values better reflect the current cost and availability of different types of capital. The market value of equity typically equals the current stock price multiplied by the number of outstanding shares, though complications can arise from employee stock options, convertible securities, and other complex capital instruments. The market value of debt proves more challenging to determine, particularly for companies with complex debt structures or privately negotiated borrowing arrangements. Many practitioners approximate debt market values using book values, adjusted for any significant changes in interest rates since the debt was issued. Applications in Corporate Finance and Investment AnalysisWACC serves as a cornerstone metric in numerous corporate finance applications, functioning primarily as a discount rate for discounted cash flow analyses and as a benchmark for evaluating investment opportunities. In the context of discounted cash flow valuation, WACC represents the appropriate discount rate for free cash flows to the firm, reflecting the blended cost of capital that all stakeholders require for their investment in the company. This application proves particularly valuable in merger and acquisition analysis, where acquirers must determine the present value of target companies' future cash flows to establish appropriate offer prices. The use of WACC as a hurdle rate for capital budgeting decisions represents another fundamental application in corporate finance practice. Companies typically require that new investment projects generate returns exceeding their WACC to ensure that these investments create value for shareholders. Projects with expected returns below the WACC may actually destroy shareholder value by diverting capital from higher-returning alternatives available in financial markets. This hurdle rate approach provides a systematic framework for comparing investment opportunities across different divisions, time periods, and risk profiles within a single organisation. However, the application of a single WACC across all projects within a company raises important questions about risk adjustment and project-specific factors. Different business segments may face varying degrees of systematic risk, competitive pressures, and market conditions that warrant different discount rates. Some companies address this challenge by calculating divisional WACCs that reflect the specific risk profiles and capital structures typical of different business lines. This approach requires careful analysis of comparable companies operating in each business segment, along with adjustments for differences in capital structure and operating leverage. The relationship between WACC and company valuation extends beyond simple discounting applications to encompass broader strategic considerations about optimal capital structure. Companies seeking to maximise their market valuation must consider how changes in their debt-to-equity ratios affect their WACC, balancing the tax advantages of additional debt against the increased financial risk and potential distress costs. This optimisation process, grounded in the trade-off theory of capital structure, recognises that the benefits of leverage eventually diminish as companies approach levels where financial distress becomes a significant concern. Economic Value Added (EVA) calculations represent another sophisticated application of WACC in corporate finance, measuring the value created by management decisions relative to the cost of capital. EVA analysis subtracts a capital charge, calculated as WACC multiplied by invested capital, from operating profits to determine whether management has created or destroyed shareholder value during a specific period. This performance measurement framework has gained widespread adoption among companies seeking to align management incentives with shareholder value creation objectives. The application of WACC in strategic planning and corporate development requires careful consideration of how different strategic initiatives might affect the company's cost of capital over time. Major acquisitions, divestitures, or changes in business strategy can significantly alter a company's risk profile and optimal capital structure, necessitating periodic recalculation of WACC. Strategic planners must anticipate these changes when evaluating long-term investment programmes or considering fundamental shifts in business focus. International applications of WACC introduce additional complexity related to currency risk, political risk, and differences in tax systems and capital market development. Companies operating in multiple countries must decide whether to use a single global WACC or to calculate country-specific discount rates that reflect local market conditions and risks. The choice between these approaches depends on factors such as the degree of integration between the company's operations in different countries, the availability of local financing sources, and the extent to which cash flows can be repatriated across borders. The Trade-Off Theory and Capital Structure OptimisationThe trade-off theory of capital structure provides the theoretical foundation for understanding how WACC varies with changes in financial leverage and how companies can potentially optimise their capital structure to minimise their cost of capital. This theory recognises that whilst debt financing offers tax advantages through deductible interest payments, increasing levels of leverage also introduce costs related to financial distress, agency conflicts, and reduced financial flexibility. The optimal capital structure represents the point where the marginal benefits of additional debt exactly offset the marginal costs, resulting in the lowest possible WACC and highest firm valuation. The tax shield component of the trade-off theory directly influences WACC calculations through the after-tax cost of debt term in the standard formula. As companies increase their use of debt financing, they initially benefit from the tax deductibility of interest payments, which reduces their overall cost of capital. However, this benefit is not unlimited, as it depends on the company's ability to generate sufficient taxable income to utilise the interest deductions fully. Companies with volatile earnings or those operating in industries with significant cyclical fluctuations may find that their ability to capture tax benefits varies considerably over time. Financial distress costs represent the primary constraint on leverage in the trade-off theory, encompassing both direct costs such as bankruptcy proceedings and legal fees, and indirect costs such as the loss of customers, suppliers, and key employees when financial difficulties become apparent. These costs are difficult to quantify precisely but can be substantial for companies in industries where reputation and ongoing relationships are critical to business success. The anticipation of financial distress costs by investors and creditors typically manifests as higher required returns on both debt and equity as leverage increases beyond moderate levels. Agency costs constitute another important element of the trade-off theory, arising from conflicts of interest between different classes of stakeholders. Higher levels of debt can create agency costs of debt, where shareholders have incentives to pursue risky projects that transfer value from bondholders to equity holders. Conversely, debt can also reduce agency costs of equity by constraining management's ability to pursue value-destroying projects or excessive perquisites. The net effect of these competing agency considerations depends on the specific governance structure and incentive systems within individual companies. The practical application of trade-off theory in WACC optimisation requires careful analysis of industry characteristics, company-specific factors, and market conditions. Companies in stable, mature industries with predictable cash flows typically can support higher levels of leverage than those in cyclical or rapidly growing industries. Similarly, companies with substantial tangible assets that can serve as collateral may be able to borrow at more favourable rates and sustain higher debt levels than asset-light companies in service industries. Market timing considerations can also influence optimal capital structure decisions and their impact on WACC. Companies may find it advantageous to issue debt when interest rates are particularly low or to issue equity when their stock price is at historical highs. These tactical considerations can temporarily move companies away from their long-term optimal capital structure, though the theory suggests that companies should eventually revert to their target leverage ratios as market conditions normalise. The dynamic nature of optimal capital structure means that companies must periodically reassess their target debt-to-equity ratios and corresponding WACC calculations. Changes in the business environment, tax regulations, or company-specific factors such as growth prospects or asset composition can shift the optimal balance between debt and equity financing. Companies that fail to adjust their capital structure in response to these changes may find themselves operating with suboptimal cost of capital and reduced firm valuation. Limitations and Practical Challenges in WACC ImplementationDespite its widespread acceptance and utility, WACC calculations face numerous limitations and practical challenges that can significantly affect their accuracy and applicability. The most fundamental limitation stems from the inherent uncertainty in estimating several key components of the calculation, particularly the cost of equity and the appropriate weights for different capital sources. These estimation challenges can lead to significant variations in calculated WACC values, depending on the specific assumptions and methodologies employed. The estimation of beta coefficients for the cost of equity calculation presents particular difficulties, as these measures of systematic risk are based on historical data that may not accurately reflect future risk characteristics. Beta calculations require sufficiently long time series of stock price data to generate statistically reliable estimates, yet longer time periods may incorporate outdated information that no longer reflects the company's current risk profile. Additionally, companies that have undergone significant structural changes, such as major acquisitions or strategic repositioning, may find that historical beta estimates provide poor guidance for future risk assessment. The choice of market risk premium represents another source of uncertainty in cost of equity calculations, with different estimation methods often yielding substantially different results. Historical risk premiums based on long-term market returns may not reflect current market conditions or investor expectations, whilst forward-looking measures derived from analyst forecasts or option pricing models may be influenced by temporary market conditions or systematic biases in expectations. This uncertainty in risk premium estimation can have substantial impacts on calculated WACC values, as the risk premium is multiplied by the company's beta coefficient. The treatment of preferred stock and other hybrid securities in WACC calculations introduces additional complexity, as these instruments often combine characteristics of both debt and equity. Preferred stock typically pays fixed dividends like debt but ranks junior to debt in bankruptcy proceedings like equity. The appropriate treatment of such instruments requires careful analysis of their specific terms and conditions, as well as consideration of how they are perceived by investors and rating agencies. Market value estimation for debt components can prove challenging, particularly for companies with complex debt structures involving multiple tranches, covenants, and embedded options. Private debt agreements may lack observable market prices, requiring approximation based on comparable publicly traded instruments or credit rating-based estimates. Additionally, off-balance-sheet obligations such as operating leases, pension obligations, and other contingent liabilities may require inclusion in debt calculations under certain circumstances, though the appropriate treatment of these items remains a matter of professional judgement. The assumption of constant capital structure weights inherent in most WACC calculations may not reflect the dynamic nature of many companies' financing strategies. Companies frequently adjust their capital structure in response to market conditions, growth opportunities, or changes in their business risk profile. Using current market values to determine weights may therefore provide a snapshot that quickly becomes outdated, whilst using target weights requires accurate assessment of management's long-term capital structure objectives. Cyclical variations in market conditions can significantly affect WACC calculations, particularly during periods of financial market stress or unusual economic conditions. Credit spreads, equity risk premiums, and risk-free rates can all fluctuate substantially over short periods, leading to significant variations in calculated WACC values. Companies must decide whether to use current market conditions or to attempt to normalise for temporary market distortions when calculating their cost of capital. The application of a single WACC to evaluate projects with different risk profiles represents a fundamental limitation of the traditional approach. Companies operating in multiple business segments or considering investments in new markets may find that a single hurdle rate fails to capture the varying risk characteristics of different opportunities. This limitation has led to the development of divisional WACC calculations and risk-adjusted discount rate approaches, though these refinements introduce their own complexities and estimation challenges. Currency and international considerations add another layer of complexity for multinational companies. Exchange rate volatility, political risks, and differences in tax systems across countries can all affect the appropriate cost of capital for international investments. Companies must decide whether to use domestic WACC calculations adjusted for international risks or to develop country-specific discount rates based on local market conditions. Real-World Implementation and Case StudiesThe practical implementation of WACC calculations in real-world corporate environments reveals the complexities and nuances that distinguish theoretical frameworks from operational reality. Major corporations typically develop sophisticated processes for WACC calculation that involve multiple departments, external consultants, and regular review cycles to ensure accuracy and relevance. These processes must balance theoretical rigour with practical constraints such as data availability, resource limitations, and the need for timely decision-making. Large technology companies provide particularly interesting case studies in WACC implementation due to their unique capital structure characteristics and growth profiles. Apple Inc., for instance, maintains substantial cash reserves alongside its debt financing, creating complexities in determining the appropriate market values for WACC calculations. The company's WACC calculation must account for its substantial foreign cash holdings, complex international tax planning strategies, and the rapid evolution of its business model from primarily hardware-focused to increasingly service-oriented. Analysts estimating Apple's cost of equity must grapple with the company's transition from a high-growth technology company to a more mature dividend-paying corporation, which affects both beta estimation and growth rate assumptions. Manufacturing companies face different challenges in WACC implementation, particularly in industries characterised by substantial capital intensity and cyclical demand patterns. The automotive industry exemplifies these challenges, where companies must balance the benefits of debt financing for large capital investments against the risks associated with cyclical downturns that can severely impact cash flows and debt service capabilities. Ford Motor Company's WACC calculations, for example, must account for the company's pension obligations, the cyclical nature of automotive demand, and the substantial capital requirements for transitioning to electric vehicle production. The financial services industry presents unique challenges for WACC calculation due to the heavily regulated nature of the business and the different role that leverage plays compared to other industries. For banks and insurance companies, debt represents both a funding source and a primary business input, as these institutions profit from the spread between their borrowing costs and lending rates. Regulatory capital requirements also introduce constraints on capital structure that may override pure economic optimisation considerations, requiring adjustments to traditional WACC frameworks. Utility companies offer insights into WACC implementation in heavily regulated industries where cost of capital calculations directly influence regulatory rate-setting processes. Electric utilities must typically justify their WACC calculations to regulatory authorities as part of rate case proceedings, requiring detailed documentation of all assumptions and methodologies. The regulated nature of these businesses typically results in more stable and predictable cash flows, which can support higher leverage ratios and potentially lower overall cost of capital. However, regulatory lag and the need for substantial infrastructure investments create unique considerations for WACC calculation and application. Private equity firms and leveraged buyout transactions demonstrate WACC concepts in highly leveraged capital structures designed to maximise returns while managing financial risk. These transactions typically involve careful optimisation of capital structure to minimise WACC whilst maintaining adequate financial flexibility to execute operational improvements and strategic initiatives. The temporary nature of many private equity investments also requires consideration of how capital structure and WACC may evolve as companies prepare for eventual exit through public offerings or strategic sales. Start-up and high-growth companies face particular challenges in WACC calculation due to limited operating history, uncertain cash flows, and rapidly evolving business models. Traditional beta estimation becomes problematic for companies with short public trading histories, requiring the use of comparable company analysis or other proxy methods. The high growth rates typical of these companies also complicate the estimation of appropriate discount rates, as investors may require substantial risk premiums to compensate for the uncertainty associated with unproven business models and competitive positions. International case studies reveal additional complexities in WACC implementation across different regulatory and market environments. European companies operating under different accounting standards and tax regimes must adapt WACC methodologies to reflect local market conditions and regulatory requirements. Emerging market companies face additional challenges related to political risk, currency volatility, and less developed capital markets that may limit the availability of reliable market data for WACC calculations. Franco Modigliani and Merton Miller: The Theoretical PioneersThe development of WACC as a cornerstone concept in corporate finance is inseparable from the groundbreaking contributions of Franco Modigliani and Merton Miller, two economists whose collaborative work in the late 1950s fundamentally transformed the academic understanding of capital structure and corporate valuation. Their partnership, which began during their tenure at Carnegie Mellon University's Graduate School of Industrial Administration, produced theoretical insights that continue to influence corporate finance practice more than six decades after their initial publication. Franco Modigliani's journey to becoming one of the most influential economists of the 20th century began in turbulent circumstances that shaped both his intellectual development and his approach to economic theory. Born in Rome in 1918, Modigliani experienced firsthand the rise of fascism in his native Italy, which ultimately forced him to flee to the United States in 1939 due to his Jewish heritage and anti-fascist political views. This early experience with political upheaval instilled in Modigliani a deep appreciation for the stability and intellectual freedom that characterised American academic institutions, influencing his lifelong commitment to rigorous economic analysis and policy-relevant research. Modigliani's academic career in the United States began at the New School of Social Research, where he completed his doctoral studies in 1944 under the supervision of economists who were themselves refugees from European fascism. This intellectual environment, characterised by a blend of European theoretical sophistication and American empirical pragmatism, profoundly influenced Modigliani's approach to economic research. His early work focused on macroeconomic theory, particularly the development of what would become known as the life-cycle hypothesis of consumption, which earned him recognition as a leading authority on household saving behaviour and macroeconomic modelling. The life-cycle hypothesis represented Modigliani's first major contribution to economic theory, proposing that individuals plan their consumption and saving decisions over their entire lifetime rather than responding solely to current income levels. This insight provided a microeconomic foundation for understanding aggregate saving patterns and their implications for economic growth and stability. The theory suggested that young people typically borrow against future income, middle-aged individuals accumulate wealth for retirement, and elderly people spend down their accumulated assets, creating predictable patterns of saving behaviour across different age cohorts. Modigliani's transition from macroeconomic theory to corporate finance occurred during his tenure at Carnegie Mellon University, where he encountered Merton Miller and began the collaboration that would revolutionise corporate finance theory. The partnership proved synergistic, combining Modigliani's theoretical sophistication with Miller's practical understanding of financial markets and institutional considerations. Their joint work addressed fundamental questions about how financing decisions affect firm value, challenging conventional wisdom that had previously gone unexamined by rigorous economic analysis. Merton Miller's background provided the perfect complement to Modigliani's theoretical orientation, bringing a practical understanding of financial markets and institutions that grounded their theoretical work in real-world considerations. Born in Boston in 1923, Miller's early career included practical experience in government service, working as an economist at the US Treasury Department and the Federal Reserve System before pursuing academic research. This exposure to policy-making and financial market operations provided Miller with insights into the practical constraints and institutional factors that influence corporate financing decisions. Miller's doctoral work at Johns Hopkins University focused on empirical economic analysis, developing skills in statistical methods and data analysis that proved crucial to the collaborative work with Modigliani. The combination of practical experience and rigorous analytical training positioned Miller to bridge the gap between theoretical economic principles and their practical implementation in corporate finance. His understanding of institutional factors such as tax regulations, bankruptcy procedures, and market microstructure considerations ensured that the theoretical framework he developed with Modigliani remained relevant to practitioners. The initial Modigliani-Miller proposition, published in 1958 in the American Economic Review, fundamentally challenged prevailing views about optimal capital structure by demonstrating that under idealised conditions, firm value remains independent of financing decisions. The theorem's proof relied on arbitrage arguments, showing that investors could replicate any corporate capital structure decision in their personal portfolios, thereby eliminating any potential value creation from financing choices. This seemingly counterintuitive result forced both academics and practitioners to reconsider their basic assumptions about corporate finance and to identify the specific market imperfections that create opportunities for value-enhancing financing decisions. The second Modigliani-Miller proposition, which incorporated corporate taxation, provided the theoretical foundation for modern WACC calculations by demonstrating that the tax deductibility of interest payments creates a genuine preference for debt financing. This refinement showed that the value of a levered firm equals the value of an otherwise identical unlevered firm plus the present value of the tax shield created by debt financing. The implication for cost of capital calculations was profound, establishing that the after-tax cost of debt should be used in WACC computations and providing theoretical justification for the tax adjustment factor that remains a cornerstone of modern WACC methodology. The intellectual courage required to challenge established orthodoxies in corporate finance cannot be overstated, as both Modigliani and Miller faced significant scepticism from academics and practitioners who found their conclusions difficult to accept. The apparent disconnect between the theorem's predictions and observed corporate behaviour led to extensive debate and research aimed at identifying the market imperfections that explain real-world capital structure patterns. This scholarly dialogue ultimately enriched the field by spurring development of more sophisticated theories that incorporate factors such as bankruptcy costs, agency problems, and information asymmetries. The recognition of Modigliani and Miller's contributions came through the highest honours available to economists, with both scholars receiving Nobel Prize recognition for their work. Modigliani received the 1985 Nobel Prize in Economic Sciences not only for the capital structure theorem but also for his contributions to consumption theory and macroeconomic modelling. Miller shared the 1990 Nobel Prize in Economic Sciences with Harry Markowitz and William Sharpe, with the Nobel Committee specifically recognising his fundamental contributions to corporate finance theory. The delay between their collaborative work and Nobel recognition reflects the time required for the academic community to fully appreciate the profound implications of their theoretical insights. The personal characteristics and working relationship between Modigliani and Miller contributed significantly to their collaborative success. Modigliani's theoretical sophistication and Miller's practical understanding created a productive tension that pushed their analysis in directions neither might have pursued independently. Their different backgrounds—Modigliani's European intellectual training and Miller's American empirical orientation—ensured that their theoretical work addressed both conceptual elegance and practical relevance. The mutual respect and intellectual chemistry between the two scholars enabled them to persist through the intensive analytical work required to develop their groundbreaking propositions. The legacy of Modigliani and Miller extends far beyond their specific theoretical contributions to encompass their influence on the entire field of corporate finance. Their work established corporate finance as a rigorous academic discipline grounded in economic theory rather than institutional description or rules of thumb. The analytical framework they developed continues to provide the conceptual foundation for advanced topics in corporate finance, including WACC calculations, capital structure optimisation, and valuation methodology. Contemporary developments in corporate finance, from behavioural finance to market microstructure analysis, build upon the theoretical foundation that Modigliani and Miller established. Contemporary Relevance and Future ImplicationsThe relevance of WACC in contemporary corporate finance has evolved significantly in response to changing market conditions, regulatory environments, and business models that characterise the modern global economy. The low interest rate environment that persisted in many developed economies following the 2008 financial crisis created unique challenges and opportunities for WACC calculation and application. Ultra-low risk-free rates compressed the cost of debt for many companies whilst simultaneously reducing the denominator in equity risk premium calculations, creating complex interactions that affected overall cost of capital estimates. The emergence of environmental, social, and governance (ESG) considerations in investment decision-making has begun to influence WACC calculations as investors increasingly incorporate sustainability factors into their required return calculations. Companies with strong ESG profiles may benefit from lower cost of capital as institutional investors demonstrate preferences for sustainable investments, whilst companies with poor ESG performance may face higher funding costs as certain investor classes exclude them from consideration. This trend suggests that future WACC calculations may need to explicitly incorporate ESG risk premiums or discounts to accurately reflect market pricing of different types of capital. Technological disruption across industries has created new challenges for WACC estimation, particularly for companies undergoing rapid digital transformation or facing disruption from new business models. Traditional comparable company analysis becomes problematic when entire industries are experiencing fundamental changes in their competitive dynamics, customer relationships, and value creation mechanisms. Companies in sectors such as retail, media, and transportation must grapple with how digital transformation affects their systematic risk profiles and appropriate cost of capital. The increasing importance of intangible assets in modern business models poses particular challenges for WACC application, as traditional valuation frameworks were developed primarily for asset-intensive industries. Technology companies, pharmaceutical firms, and other knowledge-based enterprises may find that their risk profiles differ significantly from historical patterns, requiring adjustments to beta estimation methodologies and potentially different approaches to capital structure optimisation. The difficulty of using intangible assets as collateral for debt financing may also affect optimal capital structure decisions and their impact on WACC. Globalisation and the increasing integration of international financial markets have created opportunities for multinational companies to optimise their cost of capital through strategic financing decisions across different markets. Companies can potentially reduce their WACC by accessing lower-cost capital in international markets, though they must balance these benefits against additional risks such as currency exposure, political risk, and regulatory complexity. The development of international bond markets and the increasing sophistication of currency hedging instruments have expanded the opportunities for global capital structure optimisation. The growth of alternative financing sources, including private debt markets, sovereign wealth funds, and alternative asset managers, has expanded the range of capital sources available to companies whilst potentially affecting WACC calculations. These alternative sources often have different risk preferences, return requirements, and investment horizons compared to traditional bank lenders and public equity investors. Companies accessing these markets may need to adjust their WACC calculations to reflect the specific characteristics and requirements of these alternative capital providers. Central bank policies and their impact on financial market conditions continue to influence WACC calculations across all industries and geographies. Quantitative easing programmes, forward guidance on interest rates, and other unconventional monetary policies can create distortions in traditional relationships between risk-free rates, credit spreads, and equity risk premiums. Companies and analysts must consider whether current market conditions reflect sustainable long-term relationships or temporary distortions that require adjustment in WACC calculations. The increasing frequency and severity of economic disruptions, from financial crises to global pandemics, have highlighted the importance of scenario analysis and stress testing in WACC applications. Companies are increasingly required to consider how their cost of capital might change under different economic scenarios and to incorporate these considerations into their capital allocation and risk management decisions. This trend toward more sophisticated risk analysis suggests that future WACC applications may involve multiple scenarios and dynamic adjustment mechanisms rather than single-point estimates. Regulatory developments continue to influence WACC calculations across various industries, from banking capital requirements to utility rate-setting procedures. The implementation of international accounting standards, changes in tax regulations, and evolving approaches to systemic risk regulation all affect the inputs and applications of WACC calculations. Companies operating in regulated industries must maintain particular vigilance regarding how regulatory changes might affect their cost of capital and optimal capital structure decisions. The democratisation of financial information and analytical tools through technology platforms has made sophisticated WACC calculations more accessible to smaller companies and individual investors. Cloud-based analytical platforms, automated data feeds, and artificial intelligence-powered analysis tools are reducing the barriers to implementing sophisticated cost of capital calculations. This trend may lead to more widespread and standardised application of WACC concepts across a broader range of companies and investment decisions. ConclusionThe Weighted Average Cost of Capital stands as one of the most enduring and influential concepts in modern corporate finance, bridging theoretical sophistication with practical applicability in ways that few financial metrics achieve. From its theoretical origins in the groundbreaking work of Franco Modigliani and Merton Miller to its contemporary applications across diverse industries and global markets, WACC has demonstrated remarkable adaptability whilst maintaining its core conceptual integrity. The metric's ability to synthesise complex information about market conditions, company-specific risks, and financing decisions into a single, actionable measure explains its persistence as a cornerstone tool for corporate executives, investment analysts, and strategic advisors. The comprehensive examination of WACC presented in this analysis reveals both the metric's substantial strengths and its inherent limitations. The theoretical foundation provided by the Modigliani-Miller theorem offers intellectual rigour and conceptual clarity that has withstood decades of scrutiny and refinement. Their insight that capital structure matters primarily through market imperfections such as taxation, bankruptcy costs, and agency problems continues to provide the analytical framework for understanding why WACC calculations remain relevant and valuable for corporate decision-making. The tax shield benefits incorporated in after-tax cost of debt calculations, the systematic risk adjustments embedded in cost of equity estimates, and the market value weighting approach all reflect theoretical insights that have proven their practical worth through extensive real-world application. Yet the practical challenges associated with WACC implementation cannot be understated. The difficulties inherent in estimating cost of equity through beta calculations and risk premium determinations, the complexities involved in determining appropriate market value weights for different capital sources, and the assumptions required to apply single discount rates across diverse project portfolios all highlight the gap between theoretical elegance and operational reality. These challenges require sophisticated judgement, extensive market knowledge, and careful attention to the specific circumstances of individual companies and investment decisions. The evolution of WACC applications in response to changing market conditions, regulatory environments, and business models demonstrates the metric's fundamental robustness whilst highlighting areas requiring continued development. The incorporation of ESG considerations into cost of capital calculations, the challenges posed by digital transformation and intangible asset-intensive business models, and the opportunities created by globalised capital markets all suggest directions for future refinement and enhancement of WACC methodologies. These developments require practitioners to balance theoretical consistency with practical adaptation to emerging market realities. The legacy of Franco Modigliani and Merton Miller extends far beyond their specific contributions to capital structure theory, encompassing their transformation of corporate finance from a primarily descriptive field to a rigorous academic discipline grounded in economic theory. Their intellectual courage in challenging established orthodoxies, their commitment to theoretical rigour, and their recognition of practical constraints established a model for academic research that continues to influence the field. The Nobel Prize recognition accorded to both scholars reflects not only their individual contributions but also the profound impact of their collaborative work on the development of modern finance theory. The contemporary relevance of WACC in an era of unprecedented change in financial markets, business models, and regulatory frameworks underscores both its enduring value and the need for continued innovation in its application. The challenges posed by ultra-low interest rates, the rise of alternative capital sources, the increasing importance of sustainability considerations, and the growing complexity of international business operations all require thoughtful adaptation of traditional WACC methodologies. These developments suggest that future applications of WACC may involve more sophisticated scenario analysis, dynamic adjustment mechanisms, and explicit consideration of factors that were peripheral to traditional calculations. Looking forward, the democratisation of financial analysis through technological advancement promises to make sophisticated WACC calculations more accessible whilst potentially improving their accuracy through enhanced data availability and analytical capabilities. Artificial intelligence and machine learning applications may enable more nuanced risk assessment and more accurate beta estimation, whilst real-time market data feeds could support more dynamic and responsive cost of capital calculations. However, these technological enhancements will not eliminate the need for experienced judgement in interpreting results and adapting methodologies to specific circumstances. The enduring importance of WACC in corporate finance reflects its unique ability to encapsulate complex market relationships and theoretical insights in a form that supports practical decision-making. As companies navigate an increasingly complex global business environment characterised by rapid technological change, evolving regulatory frameworks, and shifting investor preferences, the need for sophisticated approaches to cost of capital determination becomes ever more critical. WACC provides a conceptual anchor that enables decision-makers to evaluate opportunities systematically whilst remaining grounded in sound theoretical principles. The comprehensive understanding of WACC developed through this analysis emphasises the importance of viewing the metric not as a mechanical calculation but as a framework for thinking systematically about the complex relationships between risk, return, and value creation in modern business enterprises. The theoretical foundations established by Modigliani and Miller, the practical refinements developed through decades of application, and the ongoing adaptations required by changing market conditions all contribute to a rich and evolving understanding of how companies can optimise their capital allocation decisions. In an era of unprecedented change and uncertainty, this systematic approach to cost of capital determination remains as relevant and valuable as ever, providing a stable foundation for navigating the complexities of modern corporate finance.

|

| |

| |

Quote: Henry Joseph-Grant - Just-Eat founder“Ultimately an investment is an instrument of trust as much as it is of belief. Every single part of your strategy is showing you're accountable and understand your responsibility with that. Take ownership.” - Henry Joseph-Grant - Just-Eat founderHenry Joseph-Grant is widely recognised as a leading figure in the tech entrepreneurship and investment space. His career exemplifies the journey from humble beginnings to achieving major influence across international markets. Raised in Northern Ireland, Joseph-Grant’s academic pursuit in Arabic at the University of Westminster equipped him for the global business landscape, notably in his advisory work in Dubai. He began working early—starting as a paperboy at 11 and moving into various sales roles, before a pivotal tenure with Virgin. His operational calibre was cemented by his contribution to scaling JUST EAT from its UK startup phase to its landmark IPO, which resulted in a £5.25bn market capitalisation. He subsequently founded The Entertainer in partnership with Abraaj Capital, and has held senior leadership roles (Director, VP, C-level) at disruptive technology firms. Henry’s perspective is shaped by deep, hands-on engagement: navigating companies through crises, managing dramatic operational turnarounds, and leading restructuring efforts during economic shocks such as the pandemic. His experience includes acting as an angel investor, mentoring CEOs (at Seedcamp, Pitch@Palace, PiLabs) and judging major entrepreneur competitions including Richard Branson’s VOOM Pitch to Rich. Recognised among the top 25 UK entrepreneurs by Smith & Williamson, Henry is committed to fostering new generations of innovators and business leaders. Context of the QuoteThe quote captures Joseph-Grant’s core philosophy: in both entrepreneurship and investment, trust is as fundamental as belief or analytical conviction. Strategy is not simply a matter of tactics; it is a public demonstration of accountability and stewardship for others’ capital—be that from shareholders, employees, or the wider community. Trust is built through transparent, consistent ownership of outcomes, both positive and negative. This philosophy became especially salient in his leadership during industry crises, where he led teams through abrupt, challenging change, instilling a culture of responsibility and resilience. Relevant Theorists and Thought LeadersJoseph-Grant’s worldview aligns with and extends a body of thinking on trust, accountability, and stewardship within investment and leadership circles:

Each of these theorists recognised that trust is not a soft attribute, but a measurable, actionable asset—and its absence carries material risk. Joseph-Grant’s phrasing highlights the imperative for every leader, founder, and investor: take ownership is not a cliché, but a competitive advantage and ethical responsibility. Summary of InfluenceThe philosophy embedded in the quote is founded on Joseph-Grant’s lived experience, informed by crisis-tested leadership across markets and sectors. It reflects a broader intellectual tradition where trust, strategic clarity, and personal accountability are the cornerstones of sustainable investment and entrepreneurship. The challenge—and opportunity—posed is clear: in today’s interconnected, high-stakes environment, belief and trust are inseparable from value creation. Success follows when leaders are visibly accountable for the trust placed in them, at every level of the strategy.

|

| |

| |

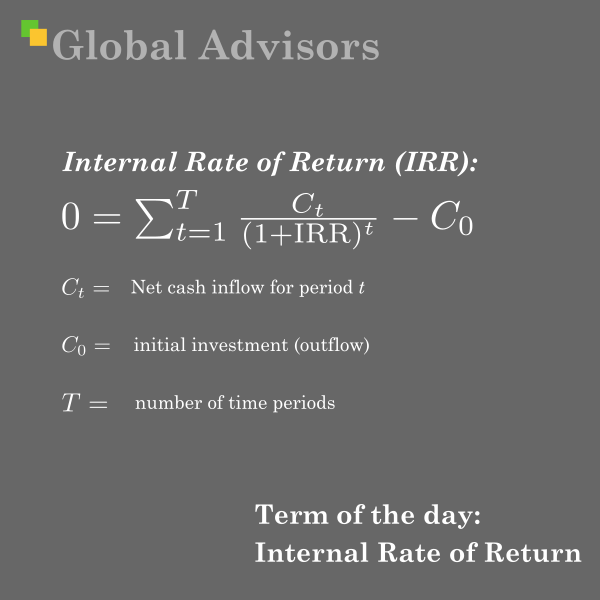

Term: Internal Rate of Return (IRR)The Internal Rate of Return (IRR) is a cornerstone metric in financial analysis, widely adopted in capital budgeting, private equity, real estate investment, and corporate strategy. IRR represents the annualised effective compounded return rate that will make the net present value (NPV) of all projected cash flows (both inflows and outflows) from an investment equal to zero. In essence, it is the discount rate at which the present value of projected cash inflows exactly balances the initial cash outlay and subsequent outflows. Calculation and Application IRR is derived using the following equation:

Where:

Analytical calculation of IRR is non-trivial (the formula is nonlinear in IRR), requiring iterative numerical methods or financial software to determine the rate that sets NPV to zero.

Role and Limitations IRR incorporates the time value of money, recognising that early or larger cash flows enhance investment attractiveness. It is particularly suited to evaluating projects with well-defined, time-based cash flows, such as real estate developments, private equity funds, and corporate capital projects. However, IRR also has notable limitations:

Strategic Context and Comparison IRR is often used in conjunction with the Weighted Average Cost of Capital (WACC) and NPV in investment appraisal. While NPV provides the monetary value added, IRR offers a uniform rate metric useful for ranking projects. Comparison to other measures:

Key Takeaways

Best Related Strategy Theorist: Irving Fisher Irving Fisher (1867–1947) is most closely associated with the conceptual foundations underlying IRR through his pioneering work in the theory of interest and investment decision making. Backstory: Fisher’s Relationship to IRR Fisher, an American economist and professor at Yale University, fundamentally reconceptualised how investors and firms should evaluate projects and capital investments. In his seminal works — notably The Rate of Interest (1907) and The Theory of Interest (1930) — Fisher introduced the principle that the rate of return on an investment should be evaluated as the discount rate at which the present value of expected future cash flows equals the current outlay. This approach constitutes the essence of IRR. Fisher’s "investment criterion" – now known as the Fisher Separation Theorem – provided a theoretical justification for corporate investment decisions being made independently of individual preferences, guided solely by maximisation of present value. His analytical frameworks directly inform the calculation and interpretation of IRR and paved the way for subsequent developments in capital budgeting and financial theory. Biography

Fisher’s work bridges economic theory and practical strategy, making him the most authoritative figure associated with the conceptual foundations and strategic application of IRR. Summary:

|

| |

| |

Quote: Dan Borge - Creator of RAROC“Risk management is designed expressly for decision makers—people who must decide what to do in uncertain situations where time is short and information is incomplete and who will experience real consequences from their decision.” - Dan Borge - Creator of RAROCBackstory and context of the quote

Who is Dan Borge?

How the quote connects to RAROC—and its contrast with RORAC

Leading theorists related to the subject

Why the quote endures

Selected biographical highlights of Dan Borge

|

| |

| |

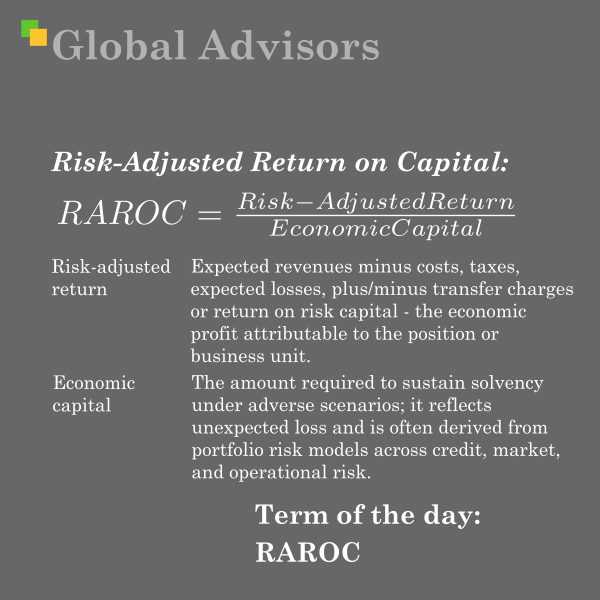

Term: Risk-Adjusted Return on Capital (RAROC)RAROC is a risk-based profitability framework that measures the risk-adjusted return earned per unit of economic capital, enabling like-for-like performance assessment, pricing, and capital allocation across activities with different risk profiles. Formally, RAROC equals risk-adjusted return (often after-tax, net of expected losses and other risk adjustments) divided by economic capital, where economic capital is the buffer held against unexpected loss across credit, market, and operational risk, commonly linked to VaR-based internal models:

Risk-Adjusted Return on Capital (RAROC) measures the risk-adjusted return earned per unit of economic capital, enabling like-for-like performance assessment, pricing, and capital allocation across activities with different risk profiles.

Key components and calculation

What RAROC is used for

Contrast: RAROC vs RORAC

Best related strategy theorist: Dan Borge

How to use RAROC well (practitioner notes)

Definitions at a glance

|

| |

| |

Quote: Dan Borge - Creator of RAROC“The purpose of risk management is to improve the future, not to explain the past.” - Dan Borge - Creator of RAROCThis line captures the pivot from retrospective control to forward-looking decision advantage that defined the modern risk discipline in banking. According to published profiles, Dan Borge was the principal architect of the first enterprise risk-management system, RAROC (Risk-Adjusted Return on Capital), developed at Bankers Trust in the late 1970s, where he served as head of strategic planning and as a senior managing director before becoming an author and consultant on strategy and risk management. His applied philosophy—set out in his book The Book of Risk and decades of practice—is that risk tools exist to shape choices, allocate scarce capital, and set prices commensurate with uncertainty so that institutions create value across cycles rather than merely rationalise outcomes after the fact. Backstory and context of the quote

Who is Dan Borge?

How the quote connects to RAROC and RORAC

Leading theorists related to the subject

Why it matters today

|

| |

| |

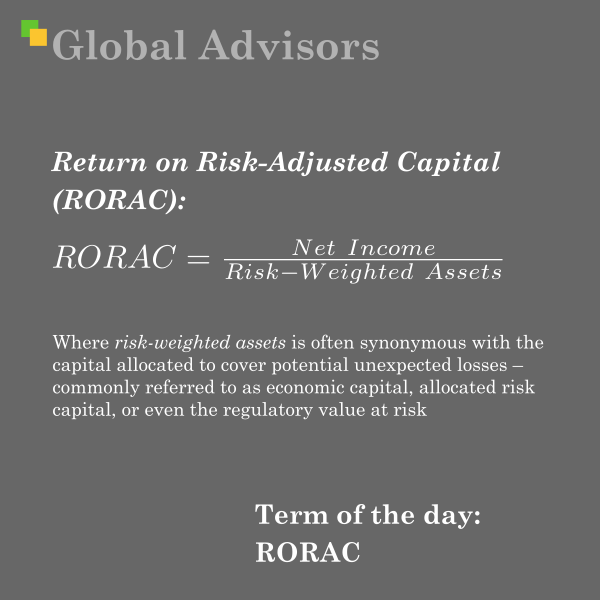

Term: Return on Risk-Adjusted Capital (RORAC)Return on Risk-Adjusted Capital (RORAC) is a financial performance metric that evaluates the profitability of a project, business unit, or company by relating net income to the amount of capital at risk, where that capital has been specifically adjusted to account for the risks inherent in the activity under review. It enables a direct comparison of returns between different business units, projects, or products that may carry differing risk profiles, allowing for a more precise assessment of economic value creation within risk management frameworks. Formula for RORAC:

Return on Risk-Adjusted Capital (RORAC) evaluates the profitability of a project, business unit, or company by relating net income to the amount of capital at risk, where that capital has been specifically adjusted to account for the risks inherent in the activity under review.

Where risk-weighted assets are often synonymous with the capital allocated to cover potential unexpected losses – commonly referred to as economic capital, allocated risk capital, or even the regulatory value at risk. Unlike Return on Equity (ROE), which uses the company’s entire equity base, RORAC employs a denominator that adjusts for the riskiness of specific lines of business or transactions. By allocating capital in proportion to risk, RORAC supports:

Contrast: RORAC vs. RAROC RORAC is a step beyond traditional metrics (like ROE) by recognising different risk profiles in how much capital is assigned, but does not fully risk-adjust the numerator. RAROC, by contrast, also incorporates provisions for expected losses and other direct adjustments to profitability, providing a purer view of economic value generation given all forms of risk. Best Related Strategy Theorist: Dan Borge Biography and Relevance: Dan Borge is widely credited as the architect of RAROC, making him instrumental to both RAROC and, by extension, RORAC. In the late 1970s, while at Bankers Trust, Borge led a project to develop a more rigorous framework for risk management and capital allocation in banking. The resulting RAROC framework was revolutionary: it introduced a risk-sensitive approach to capital allocation, integrating credit risk, market risk, and operational risk into a unified model for measuring financial performance. Borge’s contributions include:

Though Borge is not explicitly associated with RORAC by name, RORAC is widely recognised as an extension or adaptation of the principles he introduced – focusing especially on the risk-based allocation of capital for more effective resource deployment and incentive alignment. Legacy in Strategy: Summary of Key Points:

|

| |

| |

Quote: Bartley J. Madden - Value creation leader“Knowledge-building proficiency involves constructive skepticism about what we think we know. Our initial perceptions of problems and initial ideas for new products can be hindered by assumptions that are no longer valid but rarely questioned.” - Bartley J. Madden - Value creation leaderBartley J. Madden’s work is anchored in the belief that true progress—whether in business, investment, or society—depends on how proficiently we build, challenge, and revise our knowledge. The featured quote reflects decades of Madden’s inquiry into why firms succeed or fail at innovation and long-term value creation. In his view, organisations routinely fall victim to unexamined assumptions: patterns of thinking that may have driven past success, but become liabilities when environments change. Madden calls for a “constructive skepticism” that continuously tests what we think we know, identifying outdated mental models before they erode opportunity and performance. Bartley J. Madden: Life and Thought Bartley J. Madden is a leading voice in strategic finance, systems thinking, and knowledge-building practice. With a mechanical engineering degree earned from California Polytechnic State University in 1965 and an MBA from UC Berkeley, Madden’s early career took him from weapons research in the U.S. Army into the world of investment analysis. His pivotal transition came in the late 1960s, when he co-founded Callard Madden & Associates, followed by his instrumental role in developing the CFROI (Cash Flow Return on Investment) framework at Holt Value Associates—a tool now standard in evaluating corporate performance and capital allocation in global markets. Madden’s career is marked by a restless, multidisciplinary curiosity: he draws insights from engineering, cognitive psychology, philosophy, and management science. His research increasingly focused on what he termed the “knowledge-building loop” and systems thinking—a way of seeing complex business problems as networks of interconnected causes, feedback loops, and evolving assumptions, rather than linear chains of events. In both his financial and philanthropic work, including his eponymous Madden Center for Value Creation, Madden advocates for knowledge-building cultures that empower employees to challenge inherited beliefs and to experiment boldly, seeing errors as opportunities for learning rather than threats. His books—such as Value Creation Principles, Reconstructing Your Worldview, and My Value Creation Journey—emphasise systems thinking, the importance of language in shaping perception, and the need for leaders to ask better questions. Madden directly credits thinkers such as John Dewey for inspiring his conviction in inquiry-driven learning and Adelbert Ames Jr. for insights into the pitfalls of perception and assumption. Intellectual Backstory and Related Theorists Madden’s views develop within a distinguished lineage of scholars dedicated to organisational learning, systems theory, and the dynamics of innovation. Several stand out:

Application and Impact Madden’s philosophy is both a warning and a blueprint. The tendency of individuals and organisations to become trapped by their own outdated assumptions is a perennial threat. By embracing systems thinking and prioritising open, critical inquiry, businesses can build resilient cultures capable of adapting to change—creating sustained value for all stakeholders. In summary, the context of Madden’s quote is not merely a call to think differently, but a rigorous, practical manifesto for the modern organisation: challenge what you think you know, foster debate over dogma, and place knowledge-building at the core of value creation.

|

| |

| |

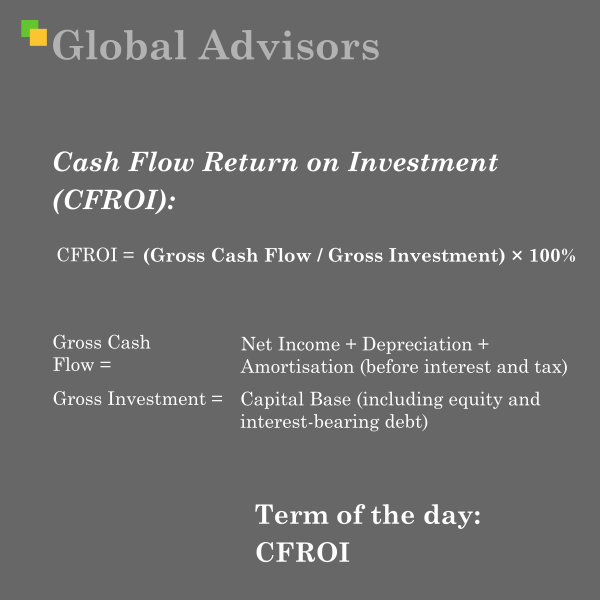

Term: Cash Flow Return on Investment (CFROI)CFROI (Cash Flow Return on Investment) is a financial performance metric designed to assess how efficiently a company generates cash returns from its invested capital, providing a clear measure of real profitability that goes beyond traditional accounting-based ratios like Return on Equity (ROE) or Return on Assets (ROA). CFROI calculates the cash yield on capital by focusing on the cash generated from business operations—before interest and taxes—relative to the total capital invested (including both equity and interest-bearing debt). This approach offers critical advantages:

The standard formula for CFROI is: CFROI = (Gross Cash Flow / Gross Investment) × 100%

Calculation notesGross Cash FlowGross Cash Flow = Net Income + Depreciation + Amortisation (before interest and tax) Notes:

Gross InvestmentGross Investment = Capital Base (including equity and interest-bearing debt) InterpretationCFROI > Cost of Capital implies value creation CFROI < Cost of Capital implies value destruction Founding Strategy Theorist and Historical BackgroundThe development of Cash Flow Return on Investment (CFROI) originated from the work of Holt Value Associates, a consultancy established by Bob Hendricks, Eric Olsen, Marvin Lipson, and Rawley Thomas in the 1980s. CFROI was created to address the deficiencies of traditional accounting ratios and valuation metrics by focusing on a company's actual cash generation and capital allocation decisions. The methodology treats each company as an investment project, evaluating the streams of cash flows generated by its assets over their productive life, adjusted for inflation and capital costs. This approach enables effective cross-company and cross-industry comparisons, providing a clearer insight into economic value creation versus destruction. CFROI rapidly gained adoption among institutional investors and corporates, offering a more accurate reflection of economic profitability than standard accounting measures, and laid the groundwork for broader value-based management practices. The metric continues to underpin performance evaluation systems for leading investment houses and strategic advisory firms, serving as a cornerstone for analysing long-term value creation in corporate finance and portfolio management.

CFROI (Cash Flow Return on Investment) is a financial performance metric designed to assess how efficiently a company generates cash returns from its invested capital, providing a clear measure of real profitability that goes beyond traditional accounting-based ratios like Return on Equity (ROE) or Return on Assets (ROA).

|

| |

| |

|

| |

| |