One-third to one-half of each animal produced for meat, milk, eggs, and fiber is not consumed by humans. These raw materials are subjected to rendering processes resulting in many useful products. Meat and bone meal, meat meal, poultry meal, hydrolyzed feather meal, blood meal, fish meal, and animal fats are the primary products resulting from the rendering process. The most important and valuable use for these animal by-products is as feed ingredients for livestock, poultry, aquaculture, and companion animals.

The approximately 300 rendering facilities in North America serve animal industries by utilizing the by-products which amount to more than half of the total volume produced by animal agriculture. The United States currently produces, slaughters, and processes approximately 100 million hogs, 35 million cattle, and eight billion chickens annually.

Animal blood plasma has in recent years become a common component of early pig and calf formulas. Plasma is a highly digestible protein source in addition to providing immune response benefits in young animals.

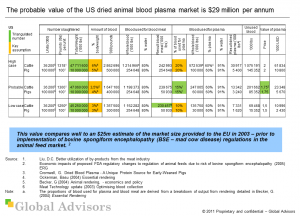

Our analysis shows that the probable value of the US dried animal blood plasma market, based on 2010 data, is $29 million per annum. This value compares well to an $25m estimate of the market size provided to the EU in 2003 ? prior to implementation of bovine spongiform encephalopathy (BSE ? mad cow disease) regulations in the animal feed market.

Click on the graphic for full-size version:

Source for description of the animal rendering and blood plasma industry: Meeker, DL; Hamilton, CR – “An Overview of the Rendering Industry” – National Renderers Association – February 2008 – accessed on 1st June 2010 at http://assets.nationalrenderers.org/essential_rendering_overview.pdf