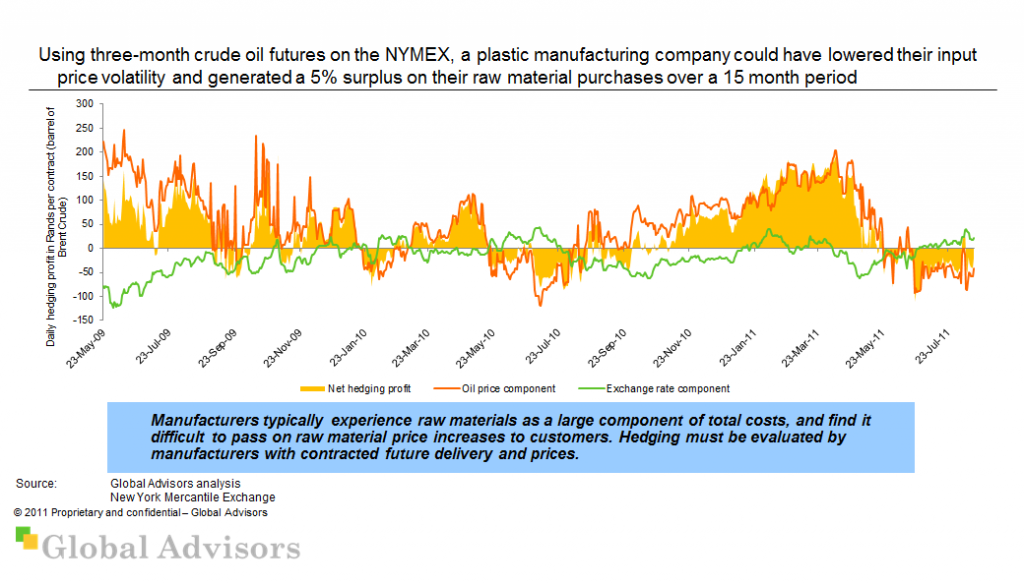

Plastic manufacturers face high raw material costs as a percentage of their total costs, and typically find it difficult to timeously pass on price increases to their customers. The volatile raw material prices that they experience are influenced by, amongst other factors, the oil price and the exchange rate. By hedging their expected future purchases by buying three-month futures for crude oil on the NYMEX, manufacturers are able to counter volatility effects and potentially boost or stabilise margins. The following graph illustrates the currency and oil market components of a three month daily hedging strategy, and the actual net effects of the strategy.