The Ansoff Matrix is a strategic-planning tool that provides a framework to help executives, senior managers, and marketers devise strategies for future growth. It is named after Russian American Igor Ansoff, who came up with the concept. Ansoff suggested that there were effectively only two approaches to developing a growth strategy; through varying what is sold (product growth) and who it is sold to (market growth).

“When we are in peak, we make a ton of money, as soon as we make a ton of money, we are desperately looking for ways to spend it. And we diversify into areas that, frankly, we don’t know how to run very well,” mused Bill Ford, great grandson of Henry. Ford’s story is neither unique nor new and companies often choose sub-optimal growth paths.

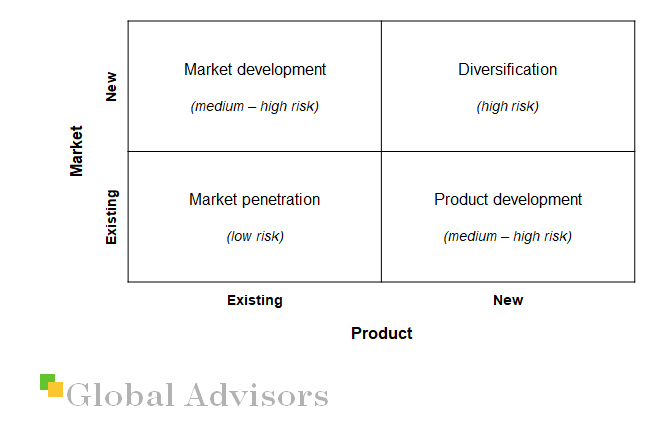

Igor Ansoff created the product / market matrix to illustrate the inherent risks in four generic growth strategies:

- Market penetration / consumption – the firm seeks to achieve growth with existing products in their current market segments, aiming to increase market share.

- Market development – the firm seeks growth by pushing its existing products into new market segments.

- Product development – the firm develops new products targeted to its existing market segments.

- Diversification – the firm grows by developing new products for new markets.

Ansoff’s Matrix

Selecting a Product-Market growth strategy

Market penetration / consumption

Market penetration and consumption covers products that are existent in an existing market. In this strategy, there can be further exploitation of the products without necessarily changing the product or the outlook of the product. This will be possible through the use of promotional methods, putting various pricing policies that may attract more clientele, or one can make the distribution more extensive.

Market penetration or consumption can also be increased is by coming up with various initiatives that will encourage increased usage of the product. A good example is the usage of toothpaste. Research has shown that the toothbrush head influences the amount of toothpaste that one will use. Thus if the head of the toothbrush is bigger it will mean that more toothpaste will be used thus promoting the usage of the toothpaste and eventually leading to more purchase of the toothpaste.

In market penetration / consumption, the risk involved is usually the least since the products are already familiar to the consumers and so is the established market.

Market development

In this strategy, the business sells its existing products to new markets. This can be made possible through further market segmentation to aid in identifying a new clientele base. This strategy assumes that the existing markets have been fully exploited thus the need to venture into new markets. There are various approaches to this strategy, which include: new geographical markets, new distribution channels, new product packaging, and different pricing policies.

Going into new geographies could involve launching the product in a completely different market. A good example is Guinness. This beer had originally been made to be sold in countries that have a colder climate, but now it is also being sold in African countries.

New distribution channels could entail selling the products via e-commerce or mail order. Selling through e-commerce may capture a larger clientele base since we are in a digital era where most people access the internet often. In new product packaging, it means repacking the product in another method or dimension. That way it may attract a different customer base. In different pricing policies, the business could change its prices so as to attract a different customer base or create a new market segment.

Product development

With a product-development growth strategy, a new product is introduced into existing markets. Product development can be from the introduction of a new product in an existing market or it can involve the modification of an existing product. By modifying the product one could change its outlook or presentation, increase the product’s performance or quality. By doing so, it can be more appealing to the existing market. A good example is car manufacturers who offer a range of car parts so as to target the car owners in purchasing additional products.

Diversification

This growth strategy involves an organisation marketing or selling new products to new markets at the same time. It is the most risky strategy as it involves two unknowns:

- New products are being created and the business does not know the development problems that may occur in the process.

- There is also the fact that there is a new market being targeted, which will bring the problem of having unknown characteristics.

For a business to take a step into diversification, they need to have their facts right regarding what it expects to gain from the strategy and have a clear assessment of the risks involved. There are two types of diversification – related diversification and unrelated diversification.

In related diversification, the business remains in the same industry in which it is currently operating. For example, a cake manufacturer diversifies into fresh-juice manufacturing. This diversification is within the food industry.

In unrelated diversification, there are usually no previous industry relations or market experiences. One can diversify from a food industry into the personal-care industry. A good example of the unrelated diversification is Richard Branson. He took advantage of the Virgin brand and diversified into various fields such as entertainment, air and rail travel, foods, etc.

Conclusion

The Ansoff matrix gives managers a framework for surveying all the initiatives the business has under way – how many are being pursued in each realm and how much investment is going to each type, and also allows managers to understand the risks and thus probability of success of each initiative.

To use the tool effectively, a company may take its sales initiatives for the next 3-5 years and place them in each of the quadrants in the matrix and analyse which quadrant shows the greatest uplift in sales. If it is in existing products to existing or new markets, or new products to existing products, there should be no cause for alarm. If it is in the new products to new markets quadrant, then this will require a greater effort at greater risk.

Companies that focus on the three quadrants other than diversification find more success as these strategies are built on familiar skills in production, purchasing, sales and marketing. An HBR study found that companies that invested 70% of their resources in core operations i.e. the market penetration quadrant, out-performed those that did not.

A diversification strategy operates in a higher plane of risk than the other three strategies. Superficially attractive and practiced by many companies, it is distracting and absorbs a disproportionately high proportion of managerial and engineering resources due to the lack of familiarity with the new venture.

Sources

- Evans, V – “25 need-to-know strategy tools” – FT Publishing – 2014

- Anonymous – “Ansoff Matrix” – Strategic Management – Quick MBA – http://www.quickmba.com/strategy/matrix/ansoff/

- Anonymous – “What is the Ansoff matrix?” – http://www.ansoffmatrix.com/

- https://en.wikipedia.org/wiki/Ansoff_Matrix

- Nagji, B; Tuff, G – “Managing Your Innovation Portfolio” – Harvard Business Review – 2012 – https://hbr.org/2012/05/managing-your-innovation-portfolio