Internet ad spending continues to grow (13,5% in 2010) and reached $26bn in the US in 2010. The most popular internet ad format in 2010 was search which represented 46% of revenue and saw 12% growth from 2009.

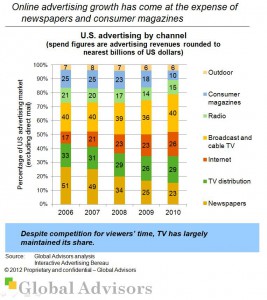

All categories of US advertisng spend grew in 2010 with the exception of newspapers (-3,2%) and consumer magazines (-0,8%).

While TV is competing for viewers’ time and with online viewing of video, US TV advertising spend grew by 6,3% in 2010.

Click the graphic to see an enlarged version.