“The purpose of risk management is to improve the future, not to explain the past.” – Dan Borge – Creator of RAROC

This line captures the pivot from retrospective control to forward-looking decision advantage that defined the modern risk discipline in banking. According to published profiles, Dan Borge was the principal architect of the first enterprise risk-management system, RAROC (Risk-Adjusted Return on Capital), developed at Bankers Trust in the late 1970s, where he served as head of strategic planning and as a senior managing director before becoming an author and consultant on strategy and risk management. His applied philosophy—set out in his book The Book of Risk and decades of practice—is that risk tools exist to shape choices, allocate scarce capital, and set prices commensurate with uncertainty so that institutions create value across cycles rather than merely rationalise outcomes after the fact.

Backstory and context of the quote

- Strategic intent over post-mortems: The quote distils the idea that risk management’s primary job is to enable better ex-ante choices—pricing, capital allocation, underwriting standards, and limits—so future outcomes improve in expected value and resilience. This is the logic behind RAROC, which evaluates opportunities on a common, risk-sensitive basis so managers can redeploy capital to the highest risk-adjusted uses.

- From accounting results to economic reality: Borge’s work shifted emphasis from accounting profit to economic profit by introducing economic capital as the denominator for performance measurement and by adjusting returns for expected losses and unhedged risks. This allows performance evaluation and risk control to be integrated, so decisions are guided by forward-looking loss distributions rather than historical averages alone.

- Institutional memory, not rear-view bias: Post-event analysis still matters, but in Borge’s framework it feeds model calibration and capital standards whose purpose is improved next-round decisions—credit selection, concentration limits, market risk hedging—rather than backward justification. This is consistent with the RAROC system’s twin purposes: risk management and performance evaluation.

- Communication and culture: As an executive and later as an author, Borge emphasised that risk is a necessary input to value creation, not merely a hazard to be minimised. His public biographies highlight a practitioner’s pedigree—engineer at Boeing, PhD in finance, two decades at Bankers Trust—grounding the quote in a career spent building tools that make organisations more adaptive to future uncertainty.

Who is Dan Borge?

- Career: Aerospace engineer at Boeing; PhD in finance from Harvard Business School; 20 years at Bankers Trust rising to senior managing director and head of strategic planning; principal architect of RAROC; subsequently an author and advisor on strategy and risk.

- Publications: Author of The Book of Risk, which translates quantitative risk concepts for executives and general readers and reflects his conviction that rigorous risk thinking should inform everyday decisions and corporate strategy.

- Lasting impact: RAROC became a standard for risk-sensitive capital allocation and pricing in global banking and influenced later regulatory and internal-capital frameworks that rely on economic capital as a buffer against unexpected losses across credit, market, and operational risks.

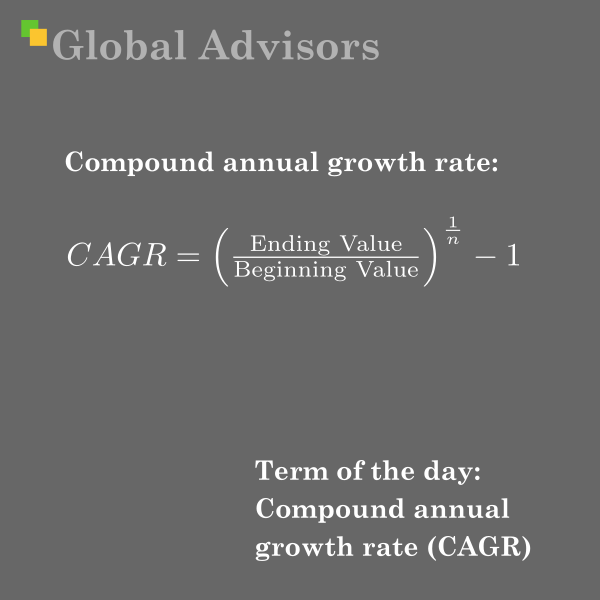

How the quote connects to RAROC and RORAC

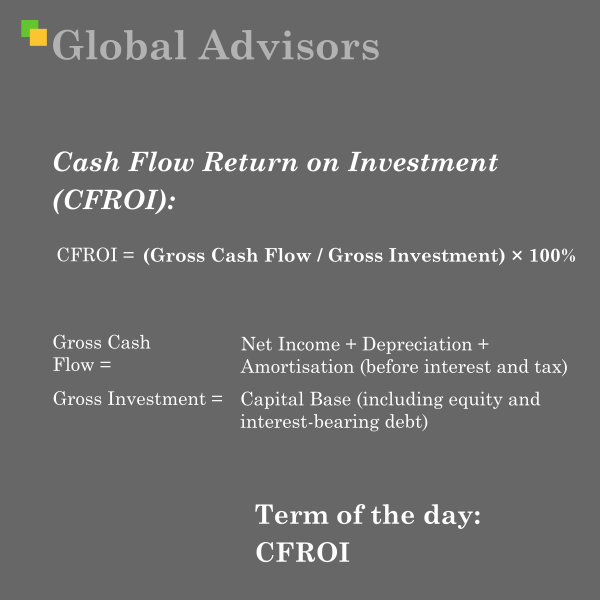

- RAROC (Risk-Adjusted Return on Capital): Measures risk-adjusted performance by comparing expected, risk-adjusted return to the economic capital required as a buffer against unexpected loss; it provides a consistent yardstick across businesses with different risk profiles. This enables management to take better future decisions on where to grow, how to price, and what to hedge—precisely the “improve the future” mandate.

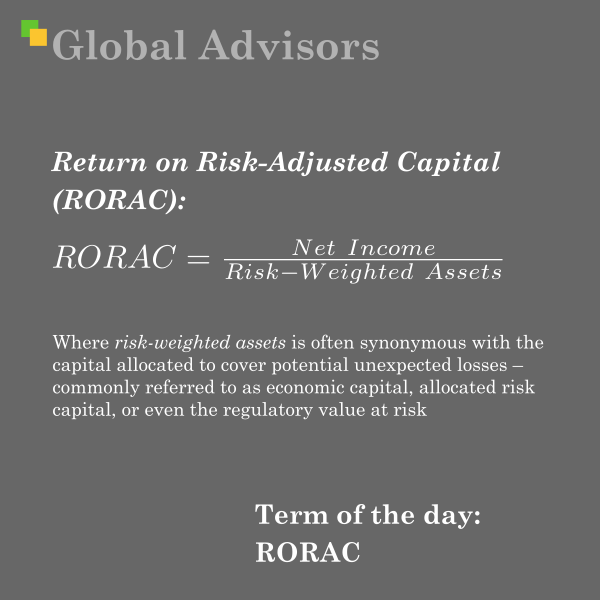

- RORAC (Return on Risk-Adjusted Capital): Uses risk-adjusted or allocated capital in the denominator but typically leaves the numerator closer to reported net income; it is often a practical intermediate step toward the full risk-adjusted measurement of RAROC and is referenced increasingly in contexts aligned with Basel capital concepts.

Leading theorists related to the subject

- Fischer Black, Myron Scholes, and Robert Merton: Their option-pricing breakthroughs and contingent-claims insights underpinned modern market risk measurement and hedging, enabling the pricing of uncertainty that RAROC-style frameworks depend on to translate risk into required capital and pricing.

- William F. Sharpe: The capital asset pricing model (CAPM) provided a foundational lens for relating expected return to systematic risk, an intellectual precursor to enterprise approaches that compare returns per unit of risk across activities.

- Dan Borge: As principal designer of RAROC at Bankers Trust, he operationalised these theoretical advances into a bank-wide system for allocating economic capital and evaluating performance, embedding risk in everyday management decisions.

Why it matters today

- Enterprise decisions under uncertainty: The move from explaining past volatility to shaping future outcomes remains central to capital planning, stress testing, and strategic allocation. RAROC-style thinking continues to inform how institutions set hurdle rates, manage concentrations, and price products across credit, market, and operational risk domains.

- Cultural anchor: The quote serves as a reminder that risk functions add the most value when they are partners in strategy—designing choices that raise long-run risk-adjusted returns—rather than historians of failure. That ethos traces directly to Borge’s contribution: risk as a discipline for better choices ahead, not merely better stories behind.